.

.

On September 29th 2021 I delivered a presentation to the UMass Boston Economics Webinar series on my recent (unpublished) paper “Information Rents, Economic Growth, and Inequality: An Empirical Study of the United States“. The slides that I prepared for my talk are available here. The recording of the event is available on YouTube and also on Zoom here. The abstract of the paper is as follows:

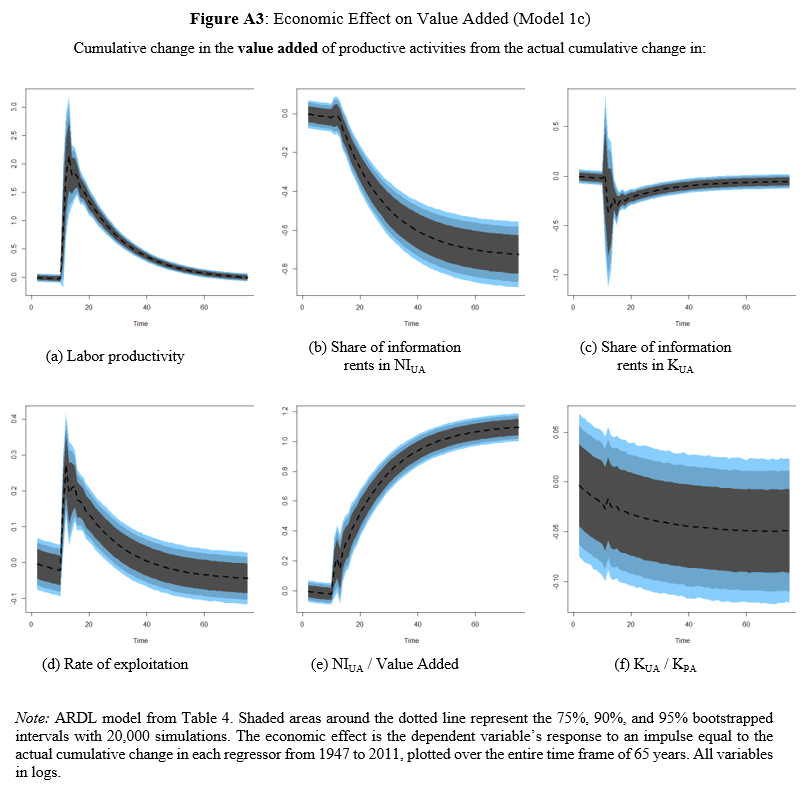

In this paper I estimate the impact of unproductive activities on economic growth, labor productivity, and income inequality in the United States from 1947 to 2011. Productive activities directly create value, while unproductive activities do not. I develop a new methodology to compute the growth of productive and unproductive activities in terms of flows of income and stocks of fixed assets using input-output matrices and national income accounts. A core feature of my methodology is the notion that the commodification of knowledge and information gives rise to “information rents”. Information rents are, as I demonstrate, a determinant factor of growth and distribution. I find that unproductive activities have a net positive effect on economic growth and labor productivity, but at the price of increasing income inequality. Unproductive activities that rely on information rents, in particular, have increased income inequality and slowed down valued-added growth despite their positive contribution to labor productivity. Information rents have drawn too much value from productive activities and benefitted the top income earners.

.

.

[…] investment and aggregate demand in activities that directly produce value added. This is what I claim in my recent working paper Information Rents, Economic Growth, and Inequality: An Empirical …. The issue of whether or not the net effects (direct plus indirect) of information rents on growth […]

[…] Link to the slides of the paper […]